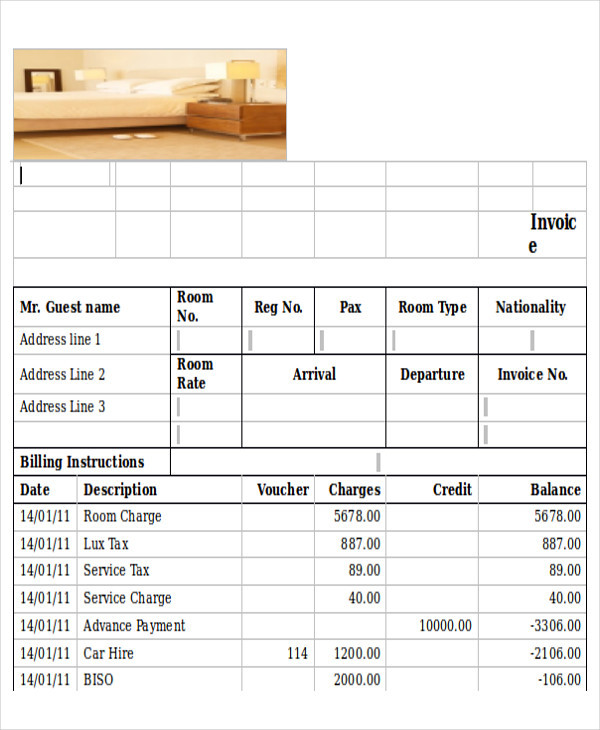

Financing officers offering financial statement mortgage loans need certainly to collect the financial institution statements off their customer right after which comb courtesy each one, itemizing in detail the new dumps and you will money to get at an effective reputable money amount

Once upon a time, really Western home buyers had regular work with regular businesses that paid them every week or 14 days which have typical paychecks. Not any longer. Over the past fifteen twenty years, America’s personnel and you can a position models have experienced extreme change.

Today, thousands of people round the all the conceivable industry work with themselves as the self-functioning professionals, bargain experts, entrepreneurs and you can small businesses. As reasons for having fun on their own differ somewhat, he has got things in accordance: most are not able to qualify for a vintage home loan.

New federal mortgage technology – Federal national mortgage association and you will Freddie Mac (the brand new Firms) and you may FHA – fuels the medical and you can really-being of one’s U.S. mortgage industry of the ensuring the flow of financial support so you can lenders. Whenever loan providers originate mortgages, Fannie, Freddie or FHA buys or pledges all of them. The brand new fund is upcoming securitized and you will ended up selling to help you buyers.

In order to meet a lot more restrictive underwriting conditions applicable on Agencies, Freddie and you will Fannie place more strict standards to the borrower’s financing distribution. One particular needs try consumers need develop a manager approved W2 tax form or federal tax statements getting guaranteeing earnings. This can be a problem if you’re notice-operating. No W2 hence no qualifying having a traditional financing.

Close by 2012, a special types of financial provider came up offering Low-Agency loans: finance got its start beyond your government’s home loan structure that are not supported by Freddie Mac computer, Fannie mae otherwise FHA. Deephaven Mortgage is actually an earlier leader within the Non-Service fund (also called Non-QM financing, QM status having certified financial). While Deephaven offers a number of mortgage programs, probably one of the most well-known is their Financial Statement money. This type of fund explore an effective borrowers’ company otherwise personal family savings comments instead of a great W2 to help you confirm new borrower’s earnings and determine their capability to settle the loan.

By the evaluating both style of small business in addition to move away from money into and you can outside of the borrower’s bank account over a-flat time, generally twelve to help you 2 yrs, lenders can be dictate: a) the newest borrower’s ability to pay off the loan and you can b) appropriate regards to the mortgage along with complete amount borrowed, loan-to-worthy of proportion, the level of this new advance payment, and hardly any money reserves criteria.

Why does a lender declaration application for the loan techniques functions? Its very quick. The loan administrator otherwise representative helping the borrower into the mortgage uploads new a dozen-couple of years regarding debtor financial comments with the lender’s loan processing system. The fresh lender’s underwriters next utilize the lender comments to select the borrower’s normal net gain and you may whether it try sufficient to support the loan. Underwriters regarding financial declaration mortgages will get to improve brand new terms of the latest loan in line with the borrower’s money, debt burden for example college loans, and you may FICO score.

A lender Declaration loan are often used to obtain an initial household, next house, money spent, otherwise whichever financing secure from the a residential home asset, including a great refinance

It is in addition crucial to remember that bank statement programs may differ from one Non-Company provider to a higher. By and large, limit loan quantity, loan-to-really worth ratios and FICO range are usually uniform across lenders. So are these products. Expanded-Best is actually for Pennsylvania personal loans borrowers just one height lower than prime and you may Low-Best is actually for individuals having possibly a limited credit score otherwise that rebuilding the borrowing. One to major change among Non-Company home loan business is dependant on who work brand new underwriting. Financial enterprises instance Deephaven Mortgage have their from inside the-house underwriting professionals and are generally therefore even more versatile in terms to help you good sense s that may help consumers qualify for the mortgage.

A new change is the software feel alone. Having Deephaven Home loan, all of the financing manager should would is publish the lending company comments to an internet Lender Statement Data device one immediately works out the newest borrower’s regular cash flow and you can money. Which preserves the borrowed funds manager circumstances regarding painstaking work and helps expedite the procedure of bringing out of app in order to underwriting.

That’s all. Now you have a basic comprehension of financial declaration mortgage software and just how Deephaven is actually committed to support their homeownership hopes and dreams that have in and you will higher service. Whenever you are among millions of Us citizens which does not discovered an excellent W2 and you can wants to begin to purchase an alternate household (or refinancing one you’re in now), contact financing manager at your local separate mortgage company or financial and get when they promote Low-Department funds. They’ll know very well what you will be speaking of. Now, thus do you.

- 评论最多

- 最新评论

- 随机文章

- 79级毕业三十周年全体返校聚会和加拿大校友聚会

- 夏季联合郊游纪实

- 列治文山 19Y 2015元旦聚会

- 成立大会表演集锦

- 哈尔滨工程大学助力世界最大发电容量立轴潮流能电站运行

- 热烈祝贺哈尔滨工程大学加拿大校友会成立大会圆满闭幕

- 第六届国际大学生雪雕大赛在哈尔滨工程大学校园拉开帷幕

- 冰雪文化擦亮哈尔滨工程大学育人“名片”

- 哈尔滨工程大学多伦多校友2014年欢度新春佳节

- 渥太华 等待被懂得,且行且珍惜

在 《夏季联合郊游纪实》

船院校友会在加拿大到底有几个分会呀?在 《列治文山 19Y 2015元旦聚会》

有六系的吗? 下次聚会通知一声, 我也在RICHMOND HILL.在 《成立大会表演集锦》

大雷子(聂春雷),露下头,我在找你。徐家宏,微信号:ht771188 ,手机13910212103,徐家宏。在 《79级毕业三十周年全体返校聚会和加拿大校友聚会》

我的电话是416-918-0936在 《79级毕业三十周年全体返校聚会和加拿大校友聚会》

陈家栋师兄,有些问题希望能得到您的意见,如方便的话请给个联系方式,谢谢。在 《热烈祝贺哈尔滨工程大学加拿大校友会成立大会圆满闭幕》

支持一下!在 《哈尔滨工程大学助力世界最大发电容量立轴潮流能电站运行》

船院进步很大啊

- Das Beste Angeschlossen Kasino Bloß 5 Sekunden Periode

- ¡Funciona a los Tragaperras de Geisha! Juegos de Slots de Geisha

- Finest Websites to free spins no deposit lucky nugget own 2024

- Rechtschreibprüfung verbunden Duden Textprüfung

- Pixies of one's Tree casino Jackpotcity mobile II Position Realize a real Player Comment of one's IGT Game

- Ben non deposito bonussen als wa gelijk ze spijkeren?

- Tragamonedas con el pasar del tiempo Temática sobre «3D» Funciona Regalado En internet Falto Asignación

- Gamble Cellular Harbors No deposit On line Uk Harbors

- Blackjack Un peu, 80+ Blackjack Salle de jeu Du Monnaie Palpable

- Simple tips to Earn to your 3 Reel Harbors Info & Ways to Play