KeyBanks Betrayal From Black And you will Reduced-Income Homeowners Proceeded In 2022

KeyBank proceeded its age-much time sanctuary of producing Black and you can reduced-income homeownership inside the 2022, an analysis really present government data into financial credit reveals.

Black individuals made just 2.6% of one’s Cleveland-centered bank’s domestic pick mortgage lending for the 2022, down from step three% the year earlier in the day. KeyBank could have been draw back off help Black homeownership yearly once the 2018, when 6.5% of their domestic pick money decided to go to a black colored debtor.

KeyBank produced 19.2% of its household pick financing on the seasons to low- and you will moderate-money (LMI) consumers, off of 19.7% in 2021. This small however, high you to-season decline understates KeyBank’s prolonged-term overall performance having low-rich family seeking buy a property to reside in: From inside the 2018 over 38% of these KeyBank finance decided to go to a keen LMI debtor.

One another analysis affairs look even uglier when comparing to most other most readily useful lenders, exactly who made more than 31% of the 2022 pick mortgages in order to LMI individuals and regarding the seven% of them so you can Black colored individuals.

KeyBank’s steady detachment of Black and you may low-rich borrowers trying to get property works restrict to the heart of your own agreement they made with area management if you find yourself seeking clearance getting a great merger inside 2016, once the a research we authored a year ago documented. In identical months out of 2018 to help you 2022 if lender is moving forward their home loan company so you’re able to wealthier, Whiter teams, their managers saw fit so you’re able to hike shareholder dividends with the the latest profits regarding the merger associated with their since the-damaged claims.

The 2022 report detailed KeyBank’s big inability within the serving low and you can moderate-money (LMI) and you can Black consumers within the organizations it pledged to aid. KeyBank in the 2016 closed a residential district Experts Contract (CBA) into the National Society Reinvestment Coalition (NCRC) and various area organizations symbolizing those same borrowers’ welfare over the country. The offer is important within the satisfying legal and you can regulating standards within the KeyBank’s successful merger with Very first Niagara Financial.

Because of the 2021, KeyBank had become the brand new poor major mortgage lender to own Black consumers. NCRC cut connections that have KeyBank shortly after reading the latest bank’s abandonment of Black and you may LMI individuals. We informed bodies your bank will be located good downgraded Community Reinvestment Act score . Although the financial institution very first awarded mistaken and you may incorrect solutions saying they had not over exactly what the amounts reveal, it had been later forced to commission a good racial collateral audit shortly after investors applied stress over our very own conclusions.

The newest 2018-2021 trend one to encouraged NCRC’s . Despite stating for increased lending so you can LMI individuals since an excellent share of its credit, KeyBank has actually failed to create significant strides. The study also next undermine KeyBank’s societal spin in response so you can NCRC’s results.

NCRC’s past statement covering 2018-2021 already coated a great damning image of KeyBank’s steps post-merger. The lending company methodically and blatantly cut back on fund into extremely borrowers they vowed to simply help and you may maps of the financing habits exhibited the lending company methodically stopped Black groups. We then found that KeyBank did not render fund equally so you’re able to Black and white individuals, and you can significantly cut the share out of lending in order to LMI consumers despite previous claims. It is currently obvious your exact same styles we were ready to recognize at financial from inside the history year’s report continued using 2022 as well.

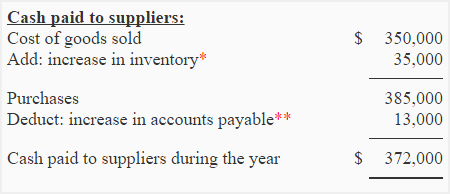

Brand new quantity to possess 2022 have earned specific perspective. This past year is actually a time period of outrageous change in the borrowed funds business, just like the rates of interest spiked to their highest point in 2 decades. Alterations in interest levels of 2021 in order to 2022 impacted every financial lenders nationwide. The latest historically low interest rates regarding 2020 and you will 2021, and this spotted the new 30-seasons repaired rates mortgage dipping to dos.65%, would give cure for a top of over eight% by the end out of 2022.

Financial Rates 2002 2022

So it offered age of lowest rates, accompanied by a spike toward highest prices into the more than 20 decades, drastically reshaped all round financial markets. Therefore it is no surprise you to KeyBank’s total home loan organization shrank dramatically during the 2021 an expression out of community-large manner. KeyBank generated 29,895 total mortgages of all sorts in 2022, off 35% away from 2021.

But which miss-off overall home loan financing is usually inspired by evaporation from re-finance and cash-out re-finance funds borrowing from the bank that’s linked with a home, although not into the trick inflection reason for the latest economic well becoming from a household that has before hired. KeyBank made lower than you to definitely-third as numerous instance low-pick mortgage loans a year ago whilst got for the 2021, shedding out of over 27,000 to lower than nine,000.

Meanwhile, household buy credit barely dipped. When you look at the 2022, KeyBank produced 9,900 family purchase loans, a comparatively more compact step 3.6% get rid of from the 10,265 such as loans they made in 2021.

Family purchase funds may be the first indicator of a great lender’s show into closure brand new racial homeownership and you may riches splits, as they depict properties putting some plunge regarding the money-deteriorating facts away from leasing into the wide range-strengthening vow of getting.

Even with handling to store the overall number of household pick lending seemingly secure into the interest turmoil from 2022, KeyBank proceeded turning from Black individuals. Just 2.6% of the house get credit went along to a black colored debtor last 12 months off in the early in the day year’s step 3% share. KeyBank features didn’t improve the household buy lending to Black homeowners. Factoring lso are-fi loans back to will not contrary one to development.

KeyBank’s a reaction to past year’s statement would be to tout an excellent 24% increase in financing to African-Us citizens, a statistic that will sound epic it is meaningless when felt from the complete display of its money. Brand new 2022 numbers still put KeyBank towards the bottom out of the major fifty loan providers in loans to Black consumers, that have only 2.5% out-of 30,895 financing planning a black colored debtor. The bank as well as rated defectively various other minority financing categories: second-terrible to possess Latina borrowers, third-worst to possess fraction-majority system financing and for financing from inside the LMI census tracts, and last-bad having minority debtor financing complete.

Ideal 50 Loan providers Inside the 2022 by the Classification

An examination of KeyBank’s interest inside their top 10 avenues corroborates these types of results. A number of avenues, KeyBank ranks at the otherwise around the base when it comes to those region elements regarding financing in order to micro loans Mentone no credit check Black colored and you can LMI homebuyers opposed towards top finance companies in terms of 2022 originations during the one to area. Its results selections of average so you can downright poor, failing woefully to prioritize resource on these very important class once again, even with pledging to take action in writing eight years ago when bodies was offered whether to agree a great merger one to made KeyBank’s insiders wealthier. The fresh numbers make sure KeyBank have not prioritized funding when you look at the LMI borrowers, despite its specific commitment to perform exactly that.

KeyBank’s Greatest Locations

The info out of 2022 merely sharpens the image out of KeyBank’s unfulfilled requirements. Its failure to help you efficiently suffice Black and you can LMI borrowers isnt only a violation from trust also a significant barrier to area advancement. Talking about not simple analytics; they show life and organizations that are nevertheless underserved. As well as after that discredit the new bank’s societal spin of its terrible carry out.

- 评论最多

- 最新评论

- 随机文章

- 79级毕业三十周年全体返校聚会和加拿大校友聚会

- 夏季联合郊游纪实

- 列治文山 19Y 2015元旦聚会

- 成立大会表演集锦

- 哈尔滨工程大学助力世界最大发电容量立轴潮流能电站运行

- 热烈祝贺哈尔滨工程大学加拿大校友会成立大会圆满闭幕

- 第六届国际大学生雪雕大赛在哈尔滨工程大学校园拉开帷幕

- 冰雪文化擦亮哈尔滨工程大学育人“名片”

- 哈尔滨工程大学多伦多校友2014年欢度新春佳节

- 渥太华 等待被懂得,且行且珍惜

在 《夏季联合郊游纪实》

船院校友会在加拿大到底有几个分会呀?在 《列治文山 19Y 2015元旦聚会》

有六系的吗? 下次聚会通知一声, 我也在RICHMOND HILL.在 《成立大会表演集锦》

大雷子(聂春雷),露下头,我在找你。徐家宏,微信号:ht771188 ,手机13910212103,徐家宏。在 《79级毕业三十周年全体返校聚会和加拿大校友聚会》

我的电话是416-918-0936在 《79级毕业三十周年全体返校聚会和加拿大校友聚会》

陈家栋师兄,有些问题希望能得到您的意见,如方便的话请给个联系方式,谢谢。在 《热烈祝贺哈尔滨工程大学加拿大校友会成立大会圆满闭幕》

支持一下!在 《哈尔滨工程大学助力世界最大发电容量立轴潮流能电站运行》

船院进步很大啊

- Free Slot crown of egypt online slot machine games playing On the internet For Enjoyable five hundred+ Harbors

- Frequently asked questions From the Organizations to type a paper For me personally

- Book Of Ra Gewinntabelle Eyes Of Horus Gratis Deklamieren & Höchstgewinn Umsetzbar

- Cuckoo Position Online

- AmunRa Promo Code October 2024, leagues of fortune online slot review five hundred, 200 FS Added bonus

- Their casino Twisted Circus rights when finalizing or cancelling a binding agreement

- Lincoln Casino Bonuses in the us 100 percent free Spins, No deposit Added bonus Rules to possess casino red dog 50 free spins 2024, Free Loans, Join Promo Password

- Twin Gambling enterprise On the internet complete Comment & Extra 2024

- Jackpot Knights Local casino Comment Discover Knight Gambling establishment zero 1

- Wo konnte man thailandische Frauen Bei Thailand treffen?