The 3 apps given just below bring financial support to reduce-income house and then make developments toward construction off house they own and you may inhabit:

OCHRA Construction Rehabilitation Financing Program

The fresh new Olmsted County Construction & Redevelopment Expert (OCHRA) possess officially released brand new Houses Treatment Program. This program will provide financial help in order to being qualified reasonable and you may modest-money home owners to help with maintaining, fixing, and you may improving the safety, livability, and energy abilities of their belongings.

That have money available with this new OCHRA, brand new Construction Rehab program offers two types of advice offered on an initial-started, first-supported foundation so you’re able to being qualified properties:

- Rehabilitation Loan: Rehabilitation Mortgage money can be used to correct risky criteria and code abuses, remove safeguards perils payday loans Derby, fix otherwise change biggest possibilities, correct interior or outside inadequacies, opportunity developments, improvement having individuals with handicaps and get rid of direct-created painting potential risks. The minimum amount borrowed try $5,000. The most offered was $twenty-five,000. Fund have an interest rate off 2%, whether or not no principle or notice money are created before the domestic is sold.

- Accessibility Mortgage: Access to Mortgage financing can be used for the fresh new removal of architectural barriers while the laying out unique products and you can equipment to possess myself disabled or earlier residents. Deductible installation and you will repairs is but they are not limited towards design out of ramps, adjustment regarding doors, reduction in basins, commodes, cupboards, having unique faucets, doorknobs, switches, and you will having handrails. There is no minimum count. The most loan amount available is $5,000. Accessibility loans is actually forgiven more than a beneficial seven-year months in accordance with a no % rate of interest.

Becoming eligible for assistance, your house needs to be situated in Olmsted State (please note, home situated in Stewartville, commonly qualified) and you also must have had your home for at least half a dozen (6) weeks prior to searching assistance. You should be latest in your mortgage as well as in the percentage of your own home/property taxation. As well, you cannot meet or exceed the household money limits here:

MHFA Rehabilitation Program

This new Minnesota Property Finance Agency’s (MHFA) Treatment Financing system facilitate reasonable so you can modest-income residents in the financial support home improvements you to definitely personally change the defense, habitability, energy efficiency, and you may the means to access of its house.

Qualified applicants need undertake your house as rehabilitated. Applicants’ assets cannot meet or exceed $twenty-five,000. Treatment Financing System earnings restrictions are based on federal average family unit members money quotes and calculated in the 29% of your Minneapolis/St. Paul urban area median income. Money limitation getting 2018 is $28,three hundred having a family group out of five.

Maximum amount borrowed try $twenty-seven,000 that have a good 15-12 months label, and ten-years to have mobile/are designed belongings taxed once the private property. Financing fee is actually forgiven if the house is not marketed otherwise transported, and you will stays occupied, during the loan name.

Extremely developments into livability, accessibility, or energy efficiency from property qualify. Electrical wiring, an alternate rooftop, plumbing work, and septic repairs just a few of the probabilities.

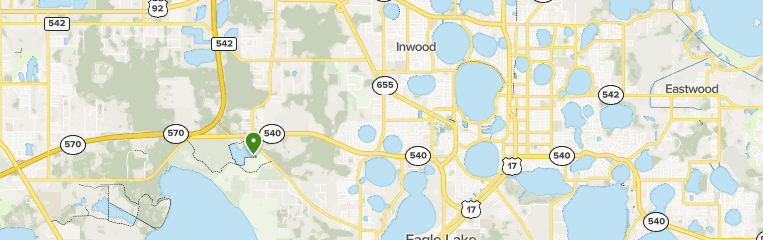

This option helps low in order to average-income residents surviving in the prospective urban area having funding home improvements that truly change the shelter, habitability, energy savings, and you will access to of the home.

The financing was notice-totally free. The maximum amount borrowed are $25,000 financing max with dos% attention. The loan was paid down if debtor carries, transfers term, or no prolonged stays in the house or property.

Very developments with the livability, accessibility, otherwise energy savings out of property are eligible. Electronic wiring, a different sort of roof, and plumbing work just some of the options.

Individuals qualified to receive this choice need undertake our home getting rehabilitated. Applicants’ assets must not exceed $twenty five,000. New qualified Modified Gross Yearly House Income Limitation for a treatment Loan is founded on the dimensions of the household. Your family earnings restrictions are prepared by the U.S. Agencies out of Construction & Urban Development (HUD) and so are revised annually. Annual income try not to exceed the reduced-money restrictions place by the HUD’s Housing Alternatives Discount Program. Earnings limitations are determined of the level of persons inside the per family.

The fresh Rochester Urban area Council keeps assigned as much as $250,000 of the Neighborhood Development Cut off Offer money compared to that program a year. This program generally speaking enhances 10-12 home annually. There clearly was constantly a waiting listing for this program. Finance are usually assigned on the fall consequently they are available the following the spring. Usually the treatment work initiate during summer.

Money constraints for 2020 HRA Rehabilitation Mortgage System

***Note: Improve dining tables in CDBG preparations and Area 3 bidding models sent 09-03-20 in order to Luke Tessum, Area Household Rehab System

- 评论最多

- 最新评论

- 随机文章

- 79级毕业三十周年全体返校聚会和加拿大校友聚会

- 夏季联合郊游纪实

- 列治文山 19Y 2015元旦聚会

- 成立大会表演集锦

- 哈尔滨工程大学助力世界最大发电容量立轴潮流能电站运行

- 热烈祝贺哈尔滨工程大学加拿大校友会成立大会圆满闭幕

- 第六届国际大学生雪雕大赛在哈尔滨工程大学校园拉开帷幕

- 冰雪文化擦亮哈尔滨工程大学育人“名片”

- 哈尔滨工程大学多伦多校友2014年欢度新春佳节

- 渥太华 等待被懂得,且行且珍惜

在 《夏季联合郊游纪实》

船院校友会在加拿大到底有几个分会呀?在 《列治文山 19Y 2015元旦聚会》

有六系的吗? 下次聚会通知一声, 我也在RICHMOND HILL.在 《成立大会表演集锦》

大雷子(聂春雷),露下头,我在找你。徐家宏,微信号:ht771188 ,手机13910212103,徐家宏。在 《79级毕业三十周年全体返校聚会和加拿大校友聚会》

我的电话是416-918-0936在 《79级毕业三十周年全体返校聚会和加拿大校友聚会》

陈家栋师兄,有些问题希望能得到您的意见,如方便的话请给个联系方式,谢谢。在 《热烈祝贺哈尔滨工程大学加拿大校友会成立大会圆满闭幕》

支持一下!在 《哈尔滨工程大学助力世界最大发电容量立轴潮流能电站运行》

船院进步很大啊

- Mr Bet Casino Erfahrungen Provision 400% so weit wie 1500, Promo Sourcecode

- A capital Ação Pela Qual Os Busca

- The brand new No-deposit Incentive casino bier haus Newest Uk Casino Offers in the October 2024

- Top 10 Android Gambling enterprises & Apps 2024 A real income Games

- Pay because of the Mobile phone Casinos in the united kingdom >Better Web sites2024

- How do i Deposit Money Onto My Athlete Subscription? Login Now & Initiate To play Fun Video game

- 1GO Kasino Bonus fährt über 50 kostenfrei Freispielen in, Maklercourtage Sourcecode!

- Finest 5 On-line casino Extra Also offers & Campaigns Aug 2024

- Starburst Totally free Revolves No-deposit Zero Betting

- Black-jack Ballroom Ranked 3 8 of 5 a hundred% to $150 slot games Beetle Frenzy Register Incentive