In the realm of monetary stability and you can credit, credit scores act as new gatekeepers deciding your qualifications to have finance and other borrowing from the bank establishment. Your credit rating is basically a mathematical symbol of your own creditworthiness, combining your credit history, repayment activities, or any other monetary behaviour toward an individual amount. When it comes to a consumer fruitful link loan, a credit score is an important criterion one lenders examine in advance of granting apps.

650 credit history signature loans

In the India, credit score are popular of the lenders to evaluate this new creditworthiness of individuals. This rating usually ranges from 300 so you’re able to 900, with large score demonstrating most useful creditworthiness. Whenever making an application for an unsecured loan, lenders often lay a minimum credit rating needs so you’re able to mitigate brand new exposure in the financing currency. Credit rating criteria alter regarding financial to financial, it all depends with the lender’s terms and conditions and other facts. But not, to own choosing of an excellent Bajaj Finserv Personal bank loan, borrowers must possess an effective CIBIL Get regarding 685 otherwise significantly more than.

Can we score a consumer loan which have a great 650 credit history having Bajaj Money Limited?

Credit score requirements differs from bank to help you financial. Bajaj Finance Restricted is renowned for their versatile financing standards and you can wide range of financial products. Which have an effective 685 credit score otherwise significantly more than, you will be entitled to a fast unsecured loan of Bajaj Loans Limited, albeit which have particular standards. When you find yourself a top credit rating carry out improve your odds of approval and probably give you finest conditions, Bajaj Finance Restricted can get thought other variables close to your credit score, such as your income balances and you will a job record.

How come CIBIL Score apply at your own application for the loan?

- Approval: A higher CIBIL Get significantly advances your odds of loan approval. Lenders perceive people with highest credit scores while the with lower borrowing threats, which makes them prone to continue borrowing.

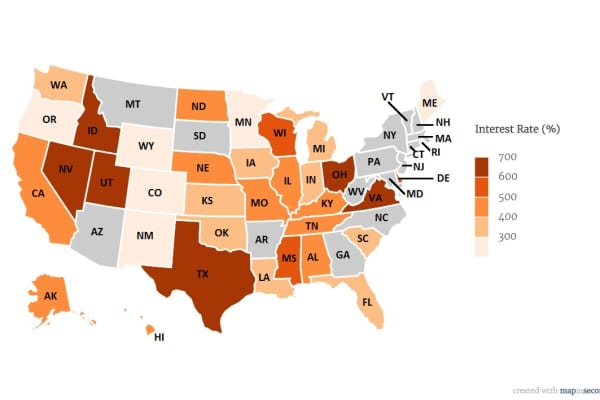

- Interest levels: The CIBIL Score actually influences the rate offered on the unsecured loan. Consumers having excellent credit ratings usually are compensated with down appeal pricing, resulting in faster complete credit costs.

- Amount borrowed: A top credit rating ount. Loan providers may give substantial sums to people with shown creditworthiness, because the mirrored inside their credit scores.

- Financing terminology: As well, individuals that have high CIBIL Rating could possibly get see way more favorable loan terminology, including lengthened installment periods and you can waived control charges. Lenders can offer preferential cures to help you consumers with sophisticated credit pages.

Just what credit rating is consumers go with?

Essentially, you really need to address a credit history from 685 or over when obtaining a personal loan. This not just grows your chances of recognition and also advances the chances of protecting significantly more beneficial mortgage terms and conditions, and additionally lower rates of interest and extended fees periods. Aside from the CIBIL Rating, you will want to meet these simple eligibility conditions mentioned lower than to qualify for a good Bajaj Money Personal bank loan:

- Nationality: India

- Age: 21 ages so you’re able to 80 ages*.

- Functioning that have: Public, private, otherwise MNC.

- Month-to-month salary: Doing Rs. 25,001, in line with the urban area you live in.

Simple tips to make an application for good Bajaj Finserv Personal loan?

- Go to the personal bank loan webpage and then click on the APPLY’

To close out, when you are a beneficial 650 credit history could possibly get discover doors to personal loan solutions, targeting a high credit rating is of good use. With a decent credit score, your not merely improve odds of mortgage approval as well as discover access to alot more favorable mortgage words, including straight down interest rates and better financing wide variety. Before you apply to own a personal loan, it’s required to determine your credit score, contrast lenders, fool around with an unsecured loan EMI calculator to help you plan your instalments smartly and you may see the fine print very carefully.

- 评论最多

- 最新评论

- 随机文章

- 79级毕业三十周年全体返校聚会和加拿大校友聚会

- 夏季联合郊游纪实

- 列治文山 19Y 2015元旦聚会

- 成立大会表演集锦

- 哈尔滨工程大学助力世界最大发电容量立轴潮流能电站运行

- 热烈祝贺哈尔滨工程大学加拿大校友会成立大会圆满闭幕

- 第六届国际大学生雪雕大赛在哈尔滨工程大学校园拉开帷幕

- 冰雪文化擦亮哈尔滨工程大学育人“名片”

- 哈尔滨工程大学多伦多校友2014年欢度新春佳节

- 渥太华 等待被懂得,且行且珍惜

在 《夏季联合郊游纪实》

船院校友会在加拿大到底有几个分会呀?在 《列治文山 19Y 2015元旦聚会》

有六系的吗? 下次聚会通知一声, 我也在RICHMOND HILL.在 《成立大会表演集锦》

大雷子(聂春雷),露下头,我在找你。徐家宏,微信号:ht771188 ,手机13910212103,徐家宏。在 《79级毕业三十周年全体返校聚会和加拿大校友聚会》

我的电话是416-918-0936在 《79级毕业三十周年全体返校聚会和加拿大校友聚会》

陈家栋师兄,有些问题希望能得到您的意见,如方便的话请给个联系方式,谢谢。在 《热烈祝贺哈尔滨工程大学加拿大校友会成立大会圆满闭幕》

支持一下!在 《哈尔滨工程大学助力世界最大发电容量立轴潮流能电站运行》

船院进步很大啊

- Spending because of the See Card in the Web based casinos

- Finest casino programs to possess playing blackjack online real money real cash online game on the mobile

- Blackjack Gratuits Quelque peu

- Free Slots Enjoyment Enjoy 3000+ Demo Slot Video game no cash

- 第六届国际大学生雪雕大赛在哈尔滨工程大学校园拉开帷幕

- Wolf Silver slot fifty Totally free Spins acceptance browse this site added bonus

- Joacă Păcănele Gratuit Spielo Sloturi Mobile Online And Jocuri 77777

- Best Bitcoin Gambling enterprise No deposit Bonus Also provides out captain nelson deluxe $1 deposit of 2024

- Mr Wager Gaming Comment: Bonuses & Offers online Roulette real money live dealers 2022

- 10 Quickest Payout Casinos on the internet and Betting Sites from 2024