Just after years of medical education, of several younger doctors are wanting to enjoy their new career that have the purchase of their first home.

https://paydayloanalabama.com/weogufka/

Unfortuitously, this new highest level of personal debt and you will reduced deals often means it dream may be out of grab many new doctors. Not just would really finance companies generally speaking want a huge advance payment, nevertheless they you prefer proof past money both of which happen to be impossible to develop getting a health care professional new from studies.

The physician mortgage was given birth to to overcome this type of demands that new physicians deal with: significant private and you will student loan indebtedness, minimal deposit availability, and in of a lot occasions a desire to personal into the an alternate domestic prior to beginning a higher purchasing condition.

Physician home loans ensure it is physicians or other physicians to safe a home loan which have a lot fewer limitations than antique finance. Doctor home loans are made particularly to match the unique monetary situations out of physicians.

Exactly what precisely certainly are the benefits associated with doctor home loans, and exactly how do it differ from old-fashioned loans? We’ve gained all the book features of these types of mortgage software having you so you can end up being completely advised since you begin your real estate travel.

Doctor Lenders versus. Traditional Mortgage loans

A physician home loan is actually a home loan accessible to doctors, dental practitioners, or any other medical professionals. They have been actually available for people!

- You could lay little currency off

- No individual mortgage insurance coverage (PMI)

- Smaller evidence of income is needed

- Capacity to be eligible for higher financing numbers

Because a physician, you’ve got a top financial obligation-to-income ratio. Even if you earn a high salary early in your career, it’s likely that their overall debt outweighs your own annual income.

The brand new DTI proportion is an important foundation in terms of getting home financing. Regrettably, extremely early-profession physicians has an undesirable DTI and, for this reason, can’t get approved.

Sometimes, a doctor financial ‘s the best possible way to have more youthful medical professionals buying residential property. Without them, of a lot medical professionals couldn’t be able to safer a home loan.

Physician mortgage brokers are a variety of jumbo loan. Such funds allow for highest balance than just FHA or traditional money, and that let you pick more substantial and more costly property.

Benefits associated with Doctor Lenders

Doctor lenders has multiple unique experts. Why don’t we discuss a few of the secret advantages you could potentially expect when looking for a doctor mortgage that meets the need.

Zero Private Home loan Insurance coverage (PMI)

Even the very infamous ability off a doctor home loan is actually the possibility to eliminate individual financial insurance rates. That have conventional money, PMI is required with the residential property financed that have lower than good 20% down-payment. Which insurance policies covers the lender any time you neglect to create your repayments and can are normally taken for .1% to 3% of loan amount according to the count financed along with your credit history.

Choosing a health care provider financial system makes you reduce or exclude financial insurance entirely and you will possibly conserve a lot of money every month.

Greatest Financial support Options

A different sort of advantageous asset of a health care provider home loan is the capability to qualify for higher financing numbers with less cash down. Within NEO Home loans, i have unique resource possibilities specifically for physicians and doctors, including:

Capability to Meet the requirements having Upcoming Earnings

Unlike demanding spend stubs to prove its income, physicians trying to get doctor mortgage brokers only have to submit its work contracts to show its earnings as opposed to newest spend stubs as the could be the circumstances to have a conventional financing. Physician mortgage applications also support loan closings around ninety days prior to the upcoming employment initiate go out.

Power to Meet the requirements having Deferred otherwise Earnings-Inspired Student loan Repayments

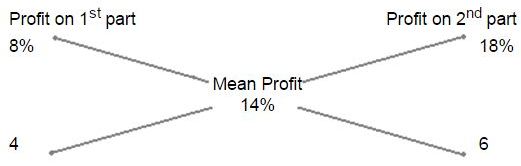

Physician home loans as well as need a separate strategy when figuring obligations-to-earnings ratios. Typical direction would want applying a-1% student loan percentage into month-to-month debts it doesn’t matter what the latest credit file shows.

Of several medical practitioner mortgage lenders disagree in how it determine such money. On NEO, we are able to qualify physicians based on earnings-depending money. This can notably reduce steadily the financial obligation-to-earnings ratio and permit to have qualification whenever almost every other percentage structures could perhaps not. We are in addition to able to completely exclude deferred student education loans that come into deferment to own medical professionals.

Software Readily available for Almost every other Experts

While most financing associations give such specialized doctor home loans purely for doctors, NEO can be applied equivalent underwriting programs to many other masters:

Joined Nurses (RN) Formal Registered nurse Anesthetists (CRNA) Doctor Assistants (PA) Medical professionals regarding Real Medication (DPT) Physicians out-of Drug inside Oral (DMD) Doctors regarding Dental care Surgery (DDS) Physicians away from Veterinarian Drug (DVM) Pharmacists Solicitors (JD) Specialized Societal Accountants (CPA) and lots of almost every other elite group designations

Is a physician Mortgage Good for you?

As an earlier doc, it’s not hard to look at the peers’ existence and you can think that you’ve fell behind. While you are looking towards very first trip to performs, they could have already purchased a house.

Which have a doctor financial, you might very own your property without having to rescue getting a 20% advance payment. And you may, you could potentially probably get a more impressive loan than simply almost every other some one.

For some doctors, a health care provider mortgage is the better method to pick a house. Yet not, you should remember that even though you are a good doctor or any other physician that does not mean a doctor loan is the better selection for your.

You have got another state, there are many financing possibilities to you personally. Since the a healthcare professional you really have far more solutions than simply extremely and you can it is essential to review an entire pricing analysis a claim that measures up all your valuable home loan options so it is possible to make an educated homebuying choices.

If you prefer to understand a little more about all of our medical practitioner domestic loan apps, fill in the proper execution lower than in order to agenda a scheduled appointment having that of our own financial advisors. They’re going to respond to all questions and create a detailed mortgage testing to help you do a solution which is finest suitable for suit your means.

- 评论最多

- 最新评论

- 随机文章

- 79级毕业三十周年全体返校聚会和加拿大校友聚会

- 哈工程乒坛赛事臻获亚军,成史上最炫黑马!

- 夏季联合郊游纪实

- 列治文山 19Y 2015元旦聚会

- 成立大会表演集锦

- 哈尔滨工程大学助力世界最大发电容量立轴潮流能电站运行

- 热烈祝贺哈尔滨工程大学加拿大校友会成立大会圆满闭幕

- 第六届国际大学生雪雕大赛在哈尔滨工程大学校园拉开帷幕

- Better The fresh Cellular Local casino Websites & Apps November 2024

- 哈尔滨工程大学多伦多校友2014年欢度新春佳节

在 《哈工程乒坛赛事臻获亚军,成史上最炫黑马!》

写的好,一气呵成,气势冲霄,真正的为完美的比赛划上了圆满的句号[img=https://s.w.org/images/core/emoji/11/svg/1f44d.svg]我代表没能前去助威呐喊却又心系比赛的校友们献花给哈工程才女使者[img=https://s.w.org/images/core/emoji/11/svg/1f490.svg][img=https://s.w.org/images/core/emoji/11/svg/1f601.svg]在 《哈工程乒坛赛事臻获亚军,成史上最炫黑马!》

师兄师姐们的精彩打拼,你的点评更是重点分明,当仁不让,一气呵成,被赋予了激流勇进的激情和饱含真情、春意盎然的美赞,堪称此次赛事完美的句点![img=https://s.w.org/images/core/emoji/11/svg/1f44d.svg]为你们骄傲,期待明年再战,再续佳绩🏆💐在 《夏季联合郊游纪实》

船院校友会在加拿大到底有几个分会呀?在 《列治文山 19Y 2015元旦聚会》

有六系的吗? 下次聚会通知一声, 我也在RICHMOND HILL.在 《成立大会表演集锦》

大雷子(聂春雷),露下头,我在找你。徐家宏,微信号:ht771188 ,手机13910212103,徐家宏。在 《79级毕业三十周年全体返校聚会和加拿大校友聚会》

我的电话是416-918-0936在 《79级毕业三十周年全体返校聚会和加拿大校友聚会》

陈家栋师兄,有些问题希望能得到您的意见,如方便的话请给个联系方式,谢谢。在 《热烈祝贺哈尔滨工程大学加拿大校友会成立大会圆满闭幕》

支持一下!在 《哈尔滨工程大学助力世界最大发电容量立轴潮流能电站运行》

船院进步很大啊

- Fairway Gambling enterprise Opinion & Recommendations Games & Welcome Incentive

- Milei sobre Petro: Sería cualquier comunista asesino cual está hundiendo en Colombia

- Better Pay From the Cellular phone Casinos Southern Africa 2024

- $2 cloud tales slot online hundred No-deposit Bonuses 2024 200 No-deposit Extra

- Energy Spielsaal Provision 30 Freispiele exklusive Einzahlung

- Totally free slot machine online burlesque hd Spins 2024 Finest 100 percent free Spins On-line casino Bonuses

- 20 Euroletten Provision abzüglich Einzahlung Kasino Ganz Infos, ganz Angebote 2024

- Majestic Slots Salle de jeu : Free Spins Ou Bonus Sans nul Classe

- Entsprechend man Twin Spin spielt Erreichbar-Spielautomaten

- Männermode: Das sind unser 13 besten Onlineshops für Sachen!

标签云集

-

列治文山

春节联欢

the lottovip

หวยออนไลน์บาทละ 1

通知

多伦多领事馆

แทงบอลออนไลน์

2015

春节聚会

摄影比赛

圣诞聚会

สมัครหวยออนไลน์

诗歌

校友故事

校友聚会

เว็บแทงหวยจ่ายจริง

หวยออนไลน์เว็บไหนดี

安大略省

中秋聚会

สมัคร bj88

成立大会

荣誉

合影

科研成果

bj88king

bitcoin bet

国际大学生雪雕大赛

bj88

สมัครแทงหวย

19街

贺信

เว็บแทงบอล

七系

หวย24

หวยออนไลน์

多伦多

เว็บหวย365

风景

หวย24 net

冰雪文化节

bj88 login

หวยออนไลน์ไม่มีเลขอั้น

创新中心

卡尔加里

2014

温哥华

渥太华

2018

科技创新

หวยดีใจ