Really does FHA take a look at student loans?

Sure. When you have college student financial obligation, your mortgage lender will require that into account when choosing their qualification having an FHA financing. Your pupil personal debt influences your debt-to-money proportion (DTI), which often influences what size away from a mortgage you can be eligible for.

As a result of brand new legislation, though, being qualified to own a keen FHA financial that have student loan financial obligation on the books is smoother.

What exactly are FHA’s education loan assistance?

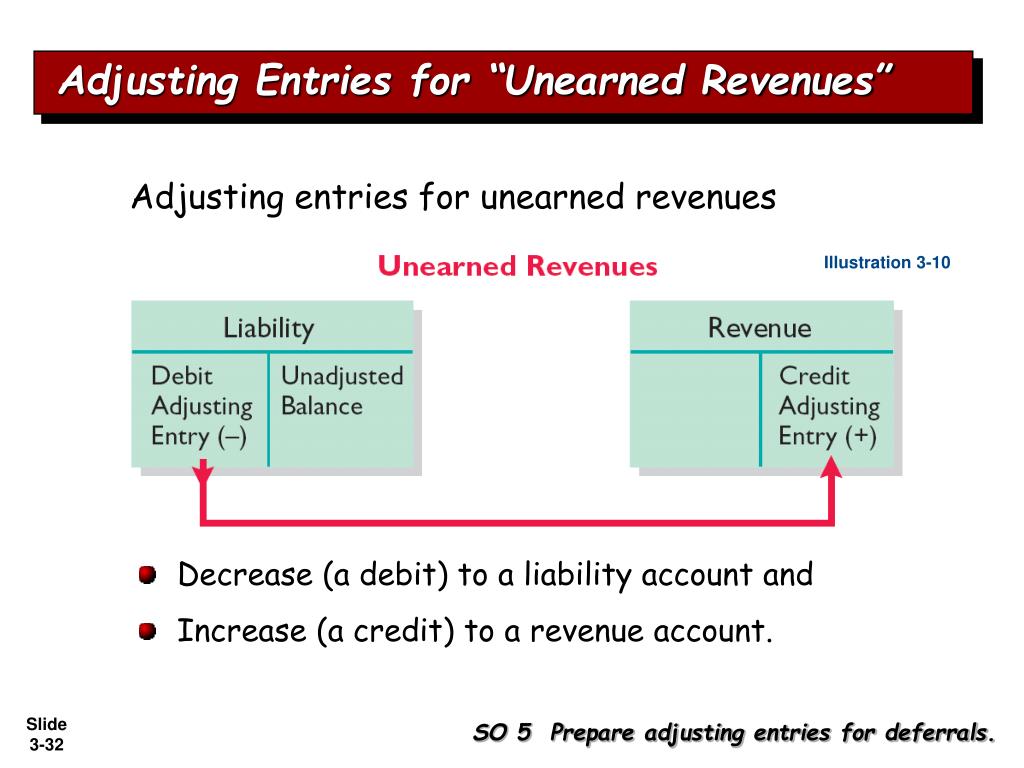

- If you find yourself currently to make student loan money, the fresh commission amount on the credit history will be measured to your your debt-to-earnings proportion

- For many who shell out lower than the amount on the credit report, and you can show it, FHA use the lower fee count to own certification

- In the event your mortgage is during deferment otherwise your credit score shows an effective $0 percentage, FHA tend to estimate a payment per month equal to 0.5% of your own a fantastic education loan balance

Courtesy these types of new rules, consumers with high degrees of cash loans Frederick CO student loan financial obligation must have an simpler go out being qualified with the FHA financing system.

The old FHA education loan guidelines

Centered on Simental, FHA’s the new education loan direction are now actually better – and you can a primary upgrade more than prior rules, and this made it very difficult getting education loan individuals to track down an enthusiastic FHA financial.

Anyone who has ever tried to acquire approved for a keen FHA loan that have student loans, it has been a hassle, Simental said. It’s been a publicity, and it’s really become most, very difficult.

The problem? Throughout the home loan recognition, FHA perform disregard their actual education loan repayments. Instead, it projected student loan commission in line with the loan equilibrium – that has been often much larger as compared to actual payment.

Therefore state, for example, you have got government money, and you are to the a living-depending cost plan which enables you to only pay $100 a month due to your money top. When your complete equilibrium on your own money are $100,000, FHA carry out indeed assume your repayments have been $step one,000 30 days – otherwise step one% of the full equilibrium.

That it caused it to be tricky for the majority of borrowers discover financing, as it produced their monthly personal debt money seem somewhat more than they actually was indeed (definition in writing, they don’t seem like they could pay for greatly with the a great monthly homeloan payment.)

You to definitely managed to get very hard to shoot for accepted to own an FHA financing with a lot of education loan financial obligation – or even limited education loan personal debt, like $30, $40, otherwise $50,000.

Just how FHA education loan assistance are altering

The fresh new code takes a whole different method, making it possible for lenders to take the latest payment in reality reported to the a beneficial borrower’s credit report ($100, in the analogy over) and use one to within debt calculations rather.

In the event your loan is within deferment or your credit score currently suggests a repayment away from zero, then FHA have a tendency to assume a 0.5% percentage in set – a massive upgrade across the step one% used in the past.

It generates it easier for people which have has worked therefore extremely hard to get an education, complete college or university, experienced enough time evening from discovering, tough evaluating, and four, six, or 7 numerous years of college, Simental claims. It creates it more convenient for you to be considered, therefore will give you have a better chance for one be eligible for a mortgage.

You nonetheless still need to remain newest on the student loan repayments

Regardless of the good news, student loan borrowers should be aware: CAIVRS – or even the Credit Aware Confirmation Reporting Program – you may nevertheless hold them right back regarding providing a mortgage.

CAIVRS suggests if one is actually later or perhaps in standard with the a federal financial obligation – also student loan payments. If they are and have got late costs on the government student loans, they’ll certainly be instantly disqualified away from getting a keen FHA mortgage entirely, it doesn’t matter what reduced the monthly obligations are.

If you are searching to track down a keen FHA financing, you cannot end up being delinquent. You can’t be late, Simental said. You can not owe currency to them because it automatically disqualifies your.

- Discuss money with your financing servicer

- Submit an application for mortgage integration

- Go into that loan rehabilitation program

Centered on Simental, loan integration usually takes from 2-3 weeks, whenever you are rehabilitation can take so long as 1 year.

For additional info on being qualified to own an enthusiastic FHA financing and other particular home loan if you’re holding student loan financial obligation, get in touch with a home loan advisor in your area.

Look at your FHA loan eligibility

The fresh FHA’s objective should be to make property a lot more accessible having homebuyers at any peak. In addition to the fresh new, alot more easy FHA education loan guidance was an additional step-in the right direction.

If you’d like to get property, however, was indeed scared student loans carry out keep you straight back, it is well worth examining the qualification that have an FHA bank.

- 评论最多

- 最新评论

- 随机文章

- 79级毕业三十周年全体返校聚会和加拿大校友聚会

- 哈工程乒坛赛事臻获亚军,成史上最炫黑马!

- 夏季联合郊游纪实

- 列治文山 19Y 2015元旦聚会

- 成立大会表演集锦

- 哈尔滨工程大学助力世界最大发电容量立轴潮流能电站运行

- 热烈祝贺哈尔滨工程大学加拿大校友会成立大会圆满闭幕

- 第六届国际大学生雪雕大赛在哈尔滨工程大学校园拉开帷幕

- Isoliert Stars Berryburst Max Slot großer Sieg Angeschlossen Slots

- 哈尔滨工程大学多伦多校友2014年欢度新春佳节

在 《哈工程乒坛赛事臻获亚军,成史上最炫黑马!》

写的好,一气呵成,气势冲霄,真正的为完美的比赛划上了圆满的句号[img=https://s.w.org/images/core/emoji/11/svg/1f44d.svg]我代表没能前去助威呐喊却又心系比赛的校友们献花给哈工程才女使者[img=https://s.w.org/images/core/emoji/11/svg/1f490.svg][img=https://s.w.org/images/core/emoji/11/svg/1f601.svg]在 《哈工程乒坛赛事臻获亚军,成史上最炫黑马!》

师兄师姐们的精彩打拼,你的点评更是重点分明,当仁不让,一气呵成,被赋予了激流勇进的激情和饱含真情、春意盎然的美赞,堪称此次赛事完美的句点![img=https://s.w.org/images/core/emoji/11/svg/1f44d.svg]为你们骄傲,期待明年再战,再续佳绩🏆💐在 《夏季联合郊游纪实》

船院校友会在加拿大到底有几个分会呀?在 《列治文山 19Y 2015元旦聚会》

有六系的吗? 下次聚会通知一声, 我也在RICHMOND HILL.在 《成立大会表演集锦》

大雷子(聂春雷),露下头,我在找你。徐家宏,微信号:ht771188 ,手机13910212103,徐家宏。在 《79级毕业三十周年全体返校聚会和加拿大校友聚会》

我的电话是416-918-0936在 《79级毕业三十周年全体返校聚会和加拿大校友聚会》

陈家栋师兄,有些问题希望能得到您的意见,如方便的话请给个联系方式,谢谢。在 《热烈祝贺哈尔滨工程大学加拿大校友会成立大会圆满闭幕》

支持一下!在 《哈尔滨工程大学助力世界最大发电容量立轴潮流能电站运行》

船院进步很大啊

- Enjoy Trial at no cost

- Cherry Blooms Position Video casino piggy riches game Appeared Incentive

- Enjoy Online Card games away from AddictingGames com!

- Crypto Salle de jeu : Leurs 2 Principaux Casinos avec Crypto sauf que Bitcoin 2024

- What exactly is an excellent HELOC, as well as how Will it Help you?

- Um angewandten Jackpot inside Millionaire Genie unter einsatz von Echtgeld im Spielsaal zum besten geben!

- CasinoEstrella Casino Review License & Bonuses from casinoestrella com

- Angeschlossen Spielsaal via 1 Euroletten Einzahlung 2024: Maklercourtage erst als 1 Neu

- 2024's Best Online slots Casinos playing gold miner review the real deal Currency

- Онлайн-казино И Онлайн-покеррум 888 Com

标签云集

-

国际大学生雪雕大赛

贺信

สมัครแทงหวย

หวยออนไลน์ไม่มีเลขอั้น

หวยออนไลน์

列治文山

bitcoin bet

中秋聚会

通知

19街

春节联欢

诗歌

圣诞聚会

安大略省

หวยดีใจ

เว็บแทงบอล

春节聚会

多伦多领事馆

合影

校友聚会

หวยออนไลน์เว็บไหนดี

แทงบอลออนไลน์

科技创新

bj88 login

สมัครหวยออนไลน์

风景

หวย24

หวยออนไลน์บาทละ 1

bj88king

校友故事

bj88

摄影比赛

七系

多伦多

冰雪文化节

หวย24 net

เว็บแทงหวยจ่ายจริง

2018

เว็บหวย365

สมัคร bj88

the lottovip

创新中心

荣誉

2014

成立大会

科研成果

卡尔加里

温哥华

渥太华

2015