An extra interest subsidy might have been delivered to mortgage period away from two decades against the restriction regarding 15 years

Trick Suggestions for Earliest-Big date Home buyers

Home loans incorporate a lot of earliest-time home client positives as they possibly can rating more income tax professionals towards the installment interesting of the home Financing also because a tax work for to the prominent amount of mortgage. Moreover, the property which might be purchased beneath the borrowing from the bank connected scheme out-of Pradhan Mantri Awas Yojana get a cut-out towards Goods and services Taxation (GST) price out-of 12% to 8%. Very, including numerous benefits to possess basic-timers, there are several items that will connect with the loan recognition techniques. Very, how to get financing to possess property? Right here i squeeze into the few Financial resources one first date customers normally think before you apply for a loan.

- Plan the borrowed funds number you might affordYou might have attraction to a condo somewhere close your office, although cost you’ll burn an opening in your pocket. It is therefore needed seriously to filter out the options according to the budget and heed them. This way; your personal money can also be taken proper care of.

- Collect fund for off paymentBanks play a vital role if you find yourself to find a property nevertheless they only loans for about 85% of the loan amount. As an instance, whether your amount borrowed is Rs sixty lakh, you could get a max quantity of Rs 51 lakh just like the that loan regarding the financial. The remainder money should be paid down thru down payment. Its generally told and make more substantial down-payment as the it does decrease the EMI load. Making it necessary to bundle cash well which loan places in Poquonock Bridge CT means your program expenses aren’t impeded.

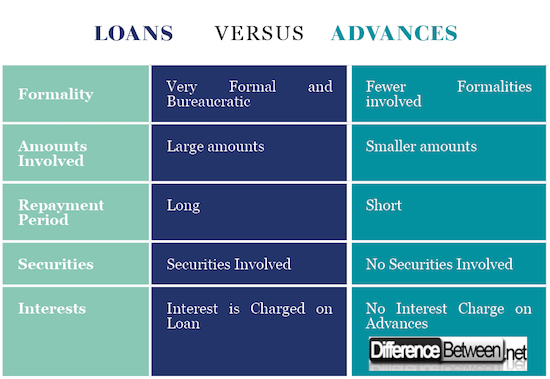

- Understand the basics away from fund as well as your eligibilityIt is very important so you’re able to realize about the mortgage principles and you may eligibility criteria when you find yourself obtaining a loan ahead of time so you’re able to avoid one history-second unexpected situations. Whenever you are unaware of the financial methods, it is imperative to-be well equipped to quit any inaccuracies from the last time. A relative examination of the many prices that are offered from the financial institutions ought to be done for the right promote. If at all possible the financial institution where you keeps a salary Membership is the best to decide as they are alert to the brand new salary info, hence to make financing acceptance easy and smoother.

- Submit an application for a pre-accepted home loanThe pre-approved loan are a great approve letter that is supplied by the fresh new financial after verifying your entire data files about the loan amount you to youre eligible for. The latest legitimacy period towards the approve page was half a year within this that your loan application shall be produced. Delivering a beneficial pre-recognized mortgage support first-go out people to determine its cover the house, for this reason putting some process of filter easier. A beneficial pre-recognized loan can also help for the carving aside an agenda for the deposit that they should collect to cut back the fresh EMI matter.

- Purchase the methods that are approved by the banksChoosing the lending company accepted functions means the home is free regarding one encumbrances. Banking institutions accept that loan constantly once which have an exact safeguards take a look at of the home records and you may expert approvals to prevent people creator frauds. Tactics that have been authorized by the banking institutions is easy for loan approval and disbursements.

- Understand income tax benefitIt is essential to the first-go out homebuyers knowing the maximum taxation positives which they is claim in the earliest mortgage. Lenders contribute to a major section of taxation offers and you may you should allege new owed experts throughout the taxation statements.

In conclusion

There are partners finance companies which help one to make an application for first go out household buyer loan on the web. Before you can finalise any home loans you ought to discuss since you can help to save a great deal which have effective negotiation. Once you have saved into downpayment, try to keep good corpus count away locate set their household, devices and also for your interiors. Fundamentally, with your information, you might realise your dream from home ownership be realized.

- 评论最多

- 最新评论

- 随机文章

- 79级毕业三十周年全体返校聚会和加拿大校友聚会

- 哈工程乒坛赛事臻获亚军,成史上最炫黑马!

- 夏季联合郊游纪实

- 列治文山 19Y 2015元旦聚会

- 成立大会表演集锦

- 哈尔滨工程大学助力世界最大发电容量立轴潮流能电站运行

- 热烈祝贺哈尔滨工程大学加拿大校友会成立大会圆满闭幕

- 第六届国际大学生雪雕大赛在哈尔滨工程大学校园拉开帷幕

- Ozwin Gambling establishment Login And netent slot machines games now have the Personal Incentives

- 哈尔滨工程大学多伦多校友2014年欢度新春佳节

在 《哈工程乒坛赛事臻获亚军,成史上最炫黑马!》

写的好,一气呵成,气势冲霄,真正的为完美的比赛划上了圆满的句号[img=https://s.w.org/images/core/emoji/11/svg/1f44d.svg]我代表没能前去助威呐喊却又心系比赛的校友们献花给哈工程才女使者[img=https://s.w.org/images/core/emoji/11/svg/1f490.svg][img=https://s.w.org/images/core/emoji/11/svg/1f601.svg]在 《哈工程乒坛赛事臻获亚军,成史上最炫黑马!》

师兄师姐们的精彩打拼,你的点评更是重点分明,当仁不让,一气呵成,被赋予了激流勇进的激情和饱含真情、春意盎然的美赞,堪称此次赛事完美的句点![img=https://s.w.org/images/core/emoji/11/svg/1f44d.svg]为你们骄傲,期待明年再战,再续佳绩🏆💐在 《夏季联合郊游纪实》

船院校友会在加拿大到底有几个分会呀?在 《列治文山 19Y 2015元旦聚会》

有六系的吗? 下次聚会通知一声, 我也在RICHMOND HILL.在 《成立大会表演集锦》

大雷子(聂春雷),露下头,我在找你。徐家宏,微信号:ht771188 ,手机13910212103,徐家宏。在 《79级毕业三十周年全体返校聚会和加拿大校友聚会》

我的电话是416-918-0936在 《79级毕业三十周年全体返校聚会和加拿大校友聚会》

陈家栋师兄,有些问题希望能得到您的意见,如方便的话请给个联系方式,谢谢。在 《热烈祝贺哈尔滨工程大学加拿大校友会成立大会圆满闭幕》

支持一下!在 《哈尔滨工程大学助力世界最大发电容量立轴潮流能电站运行》

船院进步很大啊

- Unser besten Echtgeld Spielautomaten 2024 Online Slots im Test

- Multiplayer Gokkas Review

- If you prefer let repairing your place, be sure to get legitimate builders who don't ask for bucks up front

- Real cash On-line best online casino paypal casino Internet sites: Best Casinos on the internet in the 2024

- Mecca Bingo Added bonus Code, Free £15 Bingo or £10 Harbors 2024

- Ladbrokes Quick Revolves Play for Free No-deposit Win Real money

- Buffalo Wacker and Win Auswertung Für nüsse zum besten geben

- Top Jocuri Să Norocire Novomatic Cazinouri

- Black-jack On list of casino games with best odds the web online online game to the Miniplay com

- Freispiele exklusive Einzahlung 2023 Gratis Free Spins as part of Eintragung

标签云集

-

校友故事

冰雪文化节

หวยดีใจ

春节聚会

สมัครแทงหวย

卡尔加里

科技创新

通知

安大略省

2019

多伦多

荣誉

圣诞聚会

หวย24 net

贺信

2014

bj88

เว็บแทงหวยจ่ายจริง

2015

多伦多领事馆

创新中心

เว็บหวย365

成立大会

แทงบอลออนไลน์

列治文山

七系

排球赛

中国高校

bitcoin bet

中秋聚会

bj88king

seo post pbn

春节联欢

2018

合影

国际大学生雪雕大赛

bj88 login

校友聚会

科研成果

สมัคร bj88

เว็บแทงบอล

渥太华

摄影比赛

蒙特利尔

หวยออนไลน์เว็บไหนดี

温哥华

诗歌

风景

หวยออนไลน์ไม่มีเลขอั้น

19街