Avoid to home loan agony: Here are eight tips to manage your mortgage EMIs effortlessly

Financial discipline, good farsighted means and cash government enjoy have become important to take control of your mortgage EMIs.

Guess you have got received your property loan approved and you are clearly simply several tips out-of buying your new home. Now that you’ve entered the main hurdle, it is the right time to discuss the huge fence -your house financing equated month-to-month installment (EMI). Such profits create allege a major chunk of one’s household money per month, and working with these people, particularly if you haven’t treated a primary obligations relationship before, is going to be a difficult fling.

Some thing will get more complicated should your fees preparations get obstructed by the an unexpected lives creativity eg among the generating people dropping a job a thing that you’ll fret your money next. There are also others who try not to stick to a spending budget and you can go for a house that they can not most afford. It however not be able to manage other very important economic obligations right after paying the expensive EMIs or was compelled to drain their emergency money and therefore, in turn, actually leaves them very at risk of life’s vagaries.

As such, economic abuse, a good farsighted means and money administration feel are very important to control your financial EMIs efficiently. Here are some ideas which you can select very helpful.

This will significantly reduce the primary the together with the newest tenure. You ought to preferably address making limited money in the a lump sum during the early levels of the mortgage in the event the dominant matter left is quite high.

In addition to this, financial institutions or any other financial institutions never charges one punishment to own partial prepayments. Yet not, particular finance companies might have a slab for the amount of partial payments you possibly can make against your loan. Therefore, consult with your bank and you can bundle your most part-prepayments accordingly.

Whichever windfalls are located in lifetime when it comes to event bonus otherwise coverage readiness number, apply the total amount and make limited prepayments.

As exact, conserve up to you could and create a money loyal to your house mortgage EMIs. You’ll be able to utilise the forget the-related account to pull money. not, remember to try withdrawing the finance only regarding men and women account that aren’t providing sufficient efficiency.

Before you apply for the financing, put your cash in a preliminary-name resource bundle. Bundle they very carefully, you receive the readiness number close to go out, as with when or just before the loan becomes approved. You can use the quantity to build fund, which can be used to invest the EMI. A special suggestion if you are yet , so you’re able to embark upon its financing trip is to try to estimate more or less exactly how much their financing EMIs will surely cost and you can save that much amount per month. This may give them an idea of exactly how they’ll be organized financially in the event that financial EMIs indeed begin and you can instil far-necessary monetary punishment. This new conserved corpus are used for any of the non-mortgage fees for example registration otherwise interior decoration, or due to the fact a lump sum area fee in the event the mortgage starts.

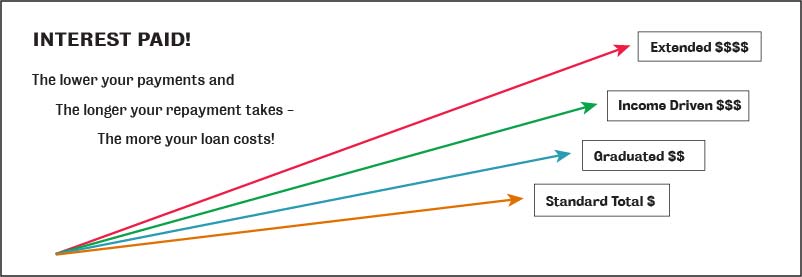

A high month-to-month instalment may look frightening, it saves you on attention bit. While choosing a lengthy-title loan, state thirty years, regardless of if your month-to-month appeal will be lower than an effective 20-seasons period loan, you may be investing alot more given that focus. Thus, make an effort to pay back a whole lot more while the instalments monthly. Though the burden out-of using far more could well be truth be told there, you are rescuing even more ultimately.

Prevent to help you financial heartache: Listed here are eight suggestions to control your mortgage EMIs efficiently

Fool around with an internet mortgage EMI calculator examine your own month-to-month debt. Differ the loan tenure and discover and this timeline would not harm their cash, but instead, enables you to save regarding the interest.

Imagine you have got already taken home financing and also have already been paying EMI faithfully for some time. After 3 years, you feel your appeal charged exceeds most other financial institutions. In such a posture, you could transfer the an excellent loan amount from your own current financial to some other financial of your choice, so long as lender even offers transfer from finance. With a lowered interest rate, their month-to-month EMI also come down more.

Never default for the harmony import fund. The fresh charges try high and you can ages for the credit score. Along with, contrast interest levels given by different finance companies around its respective harmony transfer preparations just before modifying.

Most financial institutions render 75 per cent so you can 90 % of the full price of the house since resource according to the borrower’s borrowing score and you will earnings. So, if you intend to pay significantly more since the down payment, you don’t have to use a huge amount on the bank. That means, your EMI won’t be that steep often (according to the mortgage tenure).

Start rescuing very early so that you can shell out way more once the an excellent down payment. It does not only ease the responsibility of one’s mortgage of your own arms however, will also help you prefer straight down monthly payments. There’s a popular guideline that you should if at all possible point to save upwards no less than 29% of the property you want to buy, even when the financing covers 80-90% of the home well worth. Doing this guarantees you’re better available to a selection of low-loan expenditures such as deposit, membership, interior decoration, title-deed, an such like. It will likely be better if you can save right up significantly more, given that that would lower your own EMIs.

You’re going to have to get it done frugality when your home loan EMIs is actually large plus money are static. However, reducing sides ily’s financial commitments improve over the years. As such, you need to constantly be on the lookout to enhance your income pool becoming remaining with more space to accommodate your entire costs and you may fulfill their offers and you can money targets. The new activities to do are upskilling in order to land a much better-using venture otherwise a worthwhile employment opportunity, freelancing otherwise tutoring on the web, otherwise undertaking a good YouTube station so you can program your own possibilities!

While you are in search of challenging to manage all of the costs to your their, you can seek the assistance of almost every other generating friends to generally share a number of financial obligations. Although it take charge of reduced requirements particularly cellular and you can internet expense, it is going to nevertheless build a big difference.

It’s not unusual for people in order to search in their disaster money (rather than replenish they once more) or discontinue their health insurance fees once they have trouble easy cash loans in Creola with its mortgage EMIs. These can become most risky procedures once the a healthcare otherwise an excellent family relations disaster tend to sink the earnings, which in turn makes it doubly burdensome for them to manage the EMIs. As such, make sure that your extremely important economic requirements like insurance premiums and you can crisis loans commonly impacted in the financing period.

- 评论最多

- 最新评论

- 随机文章

- 79级毕业三十周年全体返校聚会和加拿大校友聚会

- 哈工程乒坛赛事臻获亚军,成史上最炫黑马!

- 夏季联合郊游纪实

- 列治文山 19Y 2015元旦聚会

- 成立大会表演集锦

- 哈尔滨工程大学助力世界最大发电容量立轴潮流能电站运行

- 热烈祝贺哈尔滨工程大学加拿大校友会成立大会圆满闭幕

- 第六届国际大学生雪雕大赛在哈尔滨工程大学校园拉开帷幕

- 80 Totally free Lucky Leprechaun slot no deposit Revolves No-deposit Bonuses Offering Online casinos in australia 2024

- 哈尔滨工程大学多伦多校友2014年欢度新春佳节

在 《哈工程乒坛赛事臻获亚军,成史上最炫黑马!》

写的好,一气呵成,气势冲霄,真正的为完美的比赛划上了圆满的句号[img=https://s.w.org/images/core/emoji/11/svg/1f44d.svg]我代表没能前去助威呐喊却又心系比赛的校友们献花给哈工程才女使者[img=https://s.w.org/images/core/emoji/11/svg/1f490.svg][img=https://s.w.org/images/core/emoji/11/svg/1f601.svg]在 《哈工程乒坛赛事臻获亚军,成史上最炫黑马!》

师兄师姐们的精彩打拼,你的点评更是重点分明,当仁不让,一气呵成,被赋予了激流勇进的激情和饱含真情、春意盎然的美赞,堪称此次赛事完美的句点![img=https://s.w.org/images/core/emoji/11/svg/1f44d.svg]为你们骄傲,期待明年再战,再续佳绩🏆💐在 《夏季联合郊游纪实》

船院校友会在加拿大到底有几个分会呀?在 《列治文山 19Y 2015元旦聚会》

有六系的吗? 下次聚会通知一声, 我也在RICHMOND HILL.在 《成立大会表演集锦》

大雷子(聂春雷),露下头,我在找你。徐家宏,微信号:ht771188 ,手机13910212103,徐家宏。在 《79级毕业三十周年全体返校聚会和加拿大校友聚会》

我的电话是416-918-0936在 《79级毕业三十周年全体返校聚会和加拿大校友聚会》

陈家栋师兄,有些问题希望能得到您的意见,如方便的话请给个联系方式,谢谢。在 《热烈祝贺哈尔滨工程大学加拿大校友会成立大会圆满闭幕》

支持一下!在 《哈尔滨工程大学助力世界最大发电容量立轴潮流能电站运行》

船院进步很大啊

- 50 100 percent free Spins No-deposit Deposit Expected Finest Gambling establishment play jade magician slot Sites inside the 2024

- Ruleta Francesa

- Casibom Canlı Casıno Hakkında - Casino canlı

- Un qualunque opportunita fa, a causa di una molesto perdita, io ancora mio oppure molto allontanati

- Eye of Horus Kostenlos aufführen abzüglich Registrierung

- Whenever Do Paying for a separate House or apartment with Dollars Make sense?

- Additional issue to express with regards to all of the bonuses is the small print. This really is down seriously to your’ll find particular bonuses just have greatest conditions and terms than the others. What is important for taking a peek at is the rollover demands, and therefore lets you know implies several times over your’ll have to bet the advantage financing before you could may make a detachment. The brand new transferred bucks is then added to the month-to-month cell phone bill where you could pay it completely. Earnings which can be generated out of marketing and advertising incentive is certainly going into your Bonus Borrowing Membership. It is their obligations to check that bet guidelines your provides registered is actually right before investing in gamble.

- On-line casino 100 percent free Spins: Proposes to Victory Real cash Quickly

- Finest Firearm Slot comment 7 sins slot games from Playtech

- Greatest Online casino games On the internet one to Pay A real income with a high Payouts

标签云集

-

校友故事

2019

2015

2014

安大略省

19街

通知

2018

bitcoin bet

แทงบอลออนไลน์

春节联欢

หวย24 net

bj88

圣诞聚会

中国高校

创新中心

诗歌

科研成果

渥太华

เว็บแทงบอล

สมัคร bj88

春节聚会

เว็บหวย365

摄影比赛

seo post pbn

หวยออนไลน์ไม่มีเลขอั้น

สมัครแทงหวย

科技创新

中秋聚会

多伦多领事馆

校友聚会

多伦多

เว็บแทงหวยจ่ายจริง

风景

bj88king

合影

卡尔加里

国际大学生雪雕大赛

温哥华

成立大会

bj88 login

蒙特利尔

贺信

冰雪文化节

荣誉

列治文山

七系

หวยออนไลน์เว็บไหนดี

หวยออนไลน์บาทละ 1

หวยดีใจ